EU VAT, ICS, and International Regulations on ExusTrans

By automating VAT classification and applying international tax regulations, ExusTrans helps customers and carriers avoid administrative errors and remain legally compliant.

Overview of VAT and International Billing on ExusTrans

All invoices generated on ExusTrans follow Belgian VAT law and the European Union VAT Directive. The platform automatically applies the correct tax treatment based on company location, VAT registration, and transport route.

- Company location is verified

- VAT numbers are validated

- Transport route is analyzed

- Applicable tax rules are determined

- VAT is applied automatically

- Legal notes are added to invoices

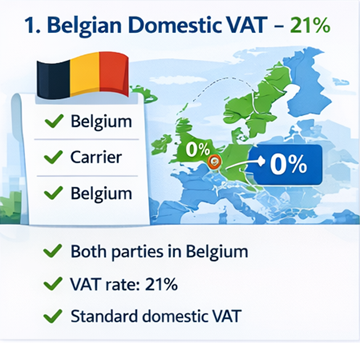

Belgian Domestic VAT – 21%

When both the customer and the carrier are established in Belgium, Belgian VAT is applied at the standard rate of 21%.

- 🇧🇪 Customer registered in Belgium

- 🚛 Carrier registered in Belgium

- 💶 VAT rate: 21%

- 📄 Belgian VAT shown on invoice

- ✅ Domestic tax compliance

This rule applies to domestic transport services and platform-related charges within Belgium.

EU Member States – Reverse Charge and Intra-Community Rules

For cross-border B2B transport services within the European Union, the reverse charge mechanism applies in most cases.

- 🌍 Customer or carrier in another EU state

- 🏢 Valid EU VAT number required

- 💶 VAT rate: 0%

- 📑 Reverse charge mechanism applied

- ⚖️ Article 44 EU VAT Directive

Under this system, VAT is reported by the customer in their own country instead of being charged by ExusTrans.

Intra-Community Supply (ICS) in Transport Services

Although ICS originally applies to goods, transport services within the EU are usually taxed under reverse charge rules. ExusTrans applies the appropriate classification automatically.

- 🔎 VAT numbers verified in VIES system

- 📍 Country codes detected

- 🧮 VAT set to 0%

- 📄 Reverse charge note added

Non-EU Customers – Outside Scope of EU VAT

When ExusTrans provides services to business customers established outside the European Union, EU VAT is not charged.

- 🌐 Customer located outside EU

- 🏢 Registered business

- 💶 VAT rate: 0%

- 📑 Outside scope of EU VAT

- ⚖️ Article 44 applied

Typical countries include Turkey, United Kingdom, Ukraine, Switzerland, United States, and other non-EU states.

Export Operations Outside the EU

Transport of goods from the EU to non-EU countries may qualify as exports and benefit from VAT exemption when supported by proper customs documentation.

- 📦 Goods leaving EU territory

- 📝 Export declaration (MRN)

- 📄 CMR or bill of lading

- 💶 VAT exemption possible

- 🔒 Documentation required

Export documentation may be requested during audits and must be retained by users.

Importation into the European Union

When goods enter the EU from non-EU countries, import VAT and customs duties are charged at the first point of entry.

- 🛃 Import VAT

- 📍 Country of entry

- 💼 Customs clearance

- 📑 Import declaration

- 🏢 Importer of record responsible

Import VAT is paid separately and is not included in ExusTrans transport invoices.

Chain Transactions and Multi-Party Transport

In transactions involving multiple buyers and sellers, special VAT rules apply to determine which supply is linked to physical transport.

- 🔄 Multiple contractual parties

- 🚛 One physical transport

- 💶 Only one exempt supply

- 📑 Other supplies taxed locally

VAT Allocation in Chain Transactions

ExusTrans analyzes transport data and contractual roles to correctly allocate VAT treatment.

- 📍 Origin and destination analysis

- 📄 Contract mapping

- 🧮 VAT assignment

- ⚖️ Regulatory compliance

Automatic VAT Detection and Validation

The ExusTrans platform uses automated systems to determine the correct VAT treatment for each invoice.

- 🔍 VAT number validation

- 📍 Company registration checks

- 🌍 Country code detection

- 🧠 Rule-based classification

- 📄 Automatic legal notes

Manual intervention is only required in exceptional cases.

User Responsibilities for Tax Compliance

While ExusTrans applies VAT rules automatically, users remain responsible for their own tax reporting and compliance.

- 🧾 VAT declarations

- 📄 Accounting records

- 📑 Customs documentation

- 🏢 Regulatory filings

- ⚖️ Legal compliance

Benefits of Automated VAT Handling

Automated VAT processing provides significant advantages for platform users.

- ✅ Reduced administrative workload

- ✅ Lower risk of errors

- ✅ Faster invoicing

- ✅ Audit-ready documentation

- ✅ International compliance

❓ Frequently Asked Questions (FAQ)

Why was 21% VAT applied to my invoice?

Belgian VAT at 21% is applied when both the customer and the carrier are registered in Belgium.

Why does my EU invoice show 0% VAT?

When one party is registered in another EU Member State with a valid VAT number, the reverse charge mechanism applies and VAT is set to 0%.

What is the reverse charge mechanism?

Under the reverse charge mechanism, VAT is reported and paid by the customer in their own country instead of being charged by ExusTrans.

Why does my invoice show 0% VAT for a non-EU company?

For business customers established outside the EU, services are classified as outside the scope of EU VAT under Article 44 and are invoiced without EU VAT.

What happens if my VAT number is missing or invalid?

If a VAT number is missing or invalid, domestic VAT may be applied automatically according to Belgian and EU regulations.

Does ExusTrans verify VAT numbers?

Yes. VAT numbers are verified automatically during registration and invoice generation using official EU validation systems.

Are export transports always VAT exempt?

Exports outside the EU may qualify for VAT exemption if supported by valid customs export documentation.

Is import VAT included in ExusTrans invoices?

No. Import VAT and customs duties are paid separately to customs authorities and are not included in ExusTrans invoices.

What is an Intra-Community Supply (ICS)?

ICS refers to cross-border supplies within the EU. For transport services, reverse charge rules usually apply instead of classic ICS treatment.

How are chain transactions handled for VAT?

In chain transactions, only the supply linked to physical transport may benefit from 0% VAT. Other supplies are taxed locally.

Can private individuals receive invoices from ExusTrans?

Yes, but different VAT rules may apply to private customers. Most ExusTrans transactions are designed for business users.

Does ExusTrans provide tax or legal advice?

No. ExusTrans provides automated billing tools but does not replace professional tax, legal, or accounting advisors.

Who is responsible for VAT reporting?

Each company is responsible for its own VAT declarations and tax reporting in accordance with local regulations.

How long are VAT-related documents stored?

Invoices and VAT-related records are stored in accordance with Belgian and EU legal retention requirements.

Conclusion

By combining Belgian tax rules, EU VAT regulations, and international standards, ExusTrans ensures that all invoices are generated correctly and transparently. Automated classification, reverse charge handling, and outside-scope treatment allow customers and carriers to operate confidently across borders.

eXus Dev